💰 Calculate your Fixed Deposit maturity amount, interest earned, and total value.

What is FD (Fixed Deposit)?

A Fixed Deposit (FD) is a secure investment option offered by banks and financial institutions that allows you to invest a lump sum amount for a fixed period at a predetermined interest rate. Unlike market-linked instruments, FD returns are guaranteed and risk-free, making them one of the most trusted savings avenues in India.

You earn interest on your deposit based on the tenure and compounding frequency chosen — monthly, quarterly, or yearly. At maturity, you receive your principal plus interest, making FDs ideal for short-term and long-term goals such as emergency funds, education, or retirement planning.

What is an FD Calculator?

An FD Calculator is an online tool that helps you calculate the maturity amount and interest earned on your fixed deposit. It instantly estimates how much your investment will grow over a specific period at a given interest rate, without needing manual calculations.

Using Business Day’s FD Calculator, you can simply enter your deposit amount, tenure, and interest rate to know exactly how much you will receive at maturity — giving you clarity and confidence before investing.

How can an FD Calculator help you?

A Fixed Deposit Calculator offers several advantages for both beginners and experienced investors:

- Instant insights: Quickly calculate your returns without complex formulas.

- Investment planning: Compare FDs of different tenures or banks to find the best rate.

- Transparency: Understand how compounding impacts your total maturity value.

- Goal tracking: Estimate how much you need to deposit today to achieve a specific future amount.

- Time-saving: Avoid manual interest calculations — results are shown instantly.

With the Business Day FD Calculator, you can plan deposits strategically and align them with your short-term or long-term financial goals.

How does an FD Calculator work?

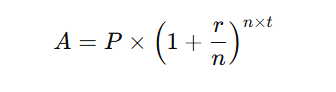

An FD calculator uses the compound interest formula to determine your maturity amount:

📘 Compound Interest Formula

Where:

- A = Maturity Amount (Principal + Interest)

- P = Principal (initial deposit)

- r = Annual interest rate (in decimal)

- n = Number of compounding periods per year

- t = Tenure (in years)

If the interest is simple, the formula used is:

A=P×(1+r×t)

Example Calculation:

| Parameter | Value |

|---|---|

| Principal (P) | ₹1,00,000 |

| Annual Interest Rate (r) | 7.5% |

| Tenure (t) | 5 years |

| Compounding | Quarterly (n = 4) |

Formula:

A = 1,00,000 × (1 + 0.075 / 4)<sup>4×5</sup>

A = ₹1,44,893

| Calculation Type | Amount |

|---|---|

| Principal | ₹1,00,000 |

| Interest Earned | ₹44,893 |

| Maturity Amount | ₹1,44,893 |

Thus, an investment of ₹1 lakh at 7.5% for 5 years (quarterly compounding) earns ₹44,893 as interest.

How to use Business Day FD Calculator?

Using the Business Day FD Calculator is effortless:

- Enter the Deposit Amount — the lump sum you wish to invest.

- Enter the Interest Rate — the annual rate offered by your bank or NBFC.

- Select Tenure — choose the investment duration in years or months.

- Choose Compounding Frequency — yearly, quarterly, or monthly.

- Click “Calculate FD” — the tool instantly displays:

- Principal invested

- Interest earned

- Maturity value

- Interactive charts showing your FD growth and return composition

This calculator can also factor in senior citizen rates and multiple compounding options to provide realistic, precise results.

Advantages of using Business Day FD Calculator

- Free and instant: No registration or charges — results appear in real time.

- Compare returns: Evaluate different banks or schemes before investing.

- Accurate projections: Uses real compounding formulas for precise estimates.

- Financial clarity: Understand the true potential of your FD investment.

- Safe and reliable: 100% browser-based tool — no data storage or tracking.

- Responsive design: Works smoothly on desktop, tablet, and mobile devices.

The Business Day FD Calculator empowers investors to make informed, data-driven decisions — whether you’re securing your savings or planning your next financial milestone.