Indian Bank Mini Statement Number Overview

Indian banks follow a mini-statement numbering system. This numbering scheme is used to identify the order in which statements are mailed to account holders. Each bank has its numbering system, so it’s important to know which bank you’re dealing with regarding your statement.

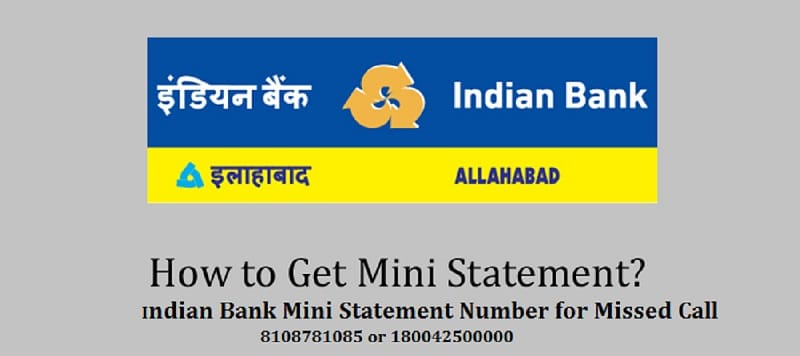

Mini statement of Indian Bank by missed call

Indian Bank has issued a mini statement regarding a missed call on an employee’s phone. The bank is investigating the call and will take appropriate action if warranted. It is the same Mini Statement of Indian Bank as a missed call we posted about in late 2016. The bank’s website did not offer any further details then, and it remains unclear what action has been taken against the person who made the call.

Indian Bank balance check number

Indian banks issue a mini statement to their customers once every month. This statement reflects a customer’s account balance and transactions during that month. In order to obtain this statement, a customer must request it from their bank, and generally, it is only available in electronic form. The mini-statement can be useful for tracking changes over time and detecting any potential financial irregularities.

How can I get a mini statement from Indian Bank through SMS?

If you want a mini statement of your bank account, you can do so through SMS. To send a message to your bank, text “MINI STATEMENT” to 22333. You will then receive a confirmation message indicating that your request has been received. The mini-statement will be available for about four weeks, and you can request it again if needed.

How can I check my last five transaction balances in Indian Bank?

If you are looking to check the balance of your last five transactions in Indian Bank, then follow these simple steps:

- Log into your online banking account.

- Select “transactions” from the menu on the left-hand side.

- Select “last 5 transactions” from the menu on the right-hand side.

- Scroll down to view your latest transaction detail and click on it to open it in a new tab/window. You will see the account number, date, amount, and status (e.g., completed, pending).

Types of Mini Statements:

There are various mini-statements that banks issue to their customers. A mini statement refers to a short document that summarizes account details. The mini-statements vary by bank, but they usually include information such as the balance, transactions, and account status. Mini statements also come in handy if you need to dispute a transaction or contact customer service.

Benefits of using mini statements:

A mini statement is a great way to keep track of your finances, and there are many benefits to using one. Mini statements can help you stay organized and track your spending. They can also help you save money on fees by avoiding over-the-counter transactions. Finally, mini-statements can help you improve your credit score if you use them to monitor your debt payments.

How to obtain a mini statement:

It would be great if you already have an account with a bank, but even if you don’t, you can still open one very easily. If you’re in the United States, more than 200 banks now offer online banking. So whether you’re looking to keep your finances on track or need quick transfers between accounts, mini-bank statements are the perfect way to stay on top.

You only need your account number and the statement date to get a mini statement from your bank. Once you have that information, sign in to the bank’s website. On the “My Accounts” page, click on “Statement & Transaction History,” and then under “Account Type,” select “Mini Statement.” Next, under “Statement Date,” type in the date of your statement and click “Submit.” You’ll now be taken to a page to view your mini-statement.

Types of Indian banks:

The Indian banking sector is highly competitive and has many banks. There are state-owned banks, private-sector banks, and foreign banks in India. State Bank of India (SBI), the largest bank in India, is state-owned. ICICI Bank and HDFC Bank are private Sector Banks. Axis Bank is a foreign bank.

Mini statement number: What is it?

A mini statement is a short form of a bank statement that banks use to provide customers with information about their balance and transactions. Mini statements are usually available 24 hours a day, seven days a week. They typically have lower transaction fees than full bank statements and are less expensive to print.

How to get a mini-statement number?

Sometimes the mini statement number is required when you want to view your bank statement online. It is especially true if you have an account with a foreign bank. In order to obtain your mini statement number, you’ll need to contact the bank directly. Here’s how:

- Log in to your online banking account.

- Click “My Accounts” on the top left of the page.

- On the My Accounts page, look for the “Statement Information” section and click on it.

- You’ll see a list of all of your current statements, as well as a link to each one. This statement’s mini-statement number will be at the bottom of this list under “View Statement.”

- Once you’ve found your statement, click on the link that says “View Statement.”

- You’ll be taken to a new page to view your statement, including the mini-statement number at the bottom!

FAQs

What is the mini-statement number?

The mini-statement number is the bank’s identifier for a financial statement.

Is this the same as a bank statement?

Yes, it’s the same thing.

Can I store my mini statement in Microsoft Outlook?

Yes, you can save it to your computer or mobile device and print it whenever you need to view it.

Can I store my mini statement in a cloud storage account like Dropbox or iCloud?

No, you can’t. Mini statements are only for personal use. We’re not able to accept requests to store your statement electronically